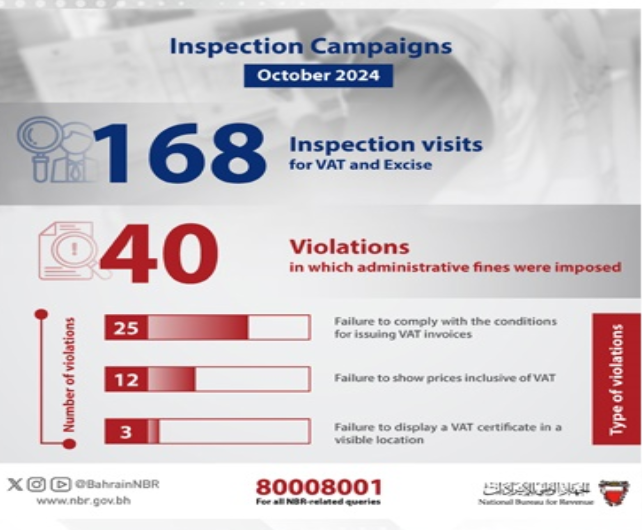

Manama : The National Bureau for Revenue (NBR) conducted 168 inspection visits within the local markets across different governorates in the Kingdom during October.

These visits are part of the NBR’s continuous commitment to enhance the level of business compliance within the local markets and ensuring adherence to all regulations and legislation for the effective implementation of VAT and Excise including the Digital Stamps Scheme. The NBR also aims to monitor the market and provide high levels of protection for consumer rights and combat VAT and Excise evasion, along with spreading awareness on the rightful ways of implementation.

The NBR has confirmed that effective oversight of the local market has resulted in reporting a total of 40 VAT violations, in which administrative fines have been imposed in accordance with the Law. The reported violations were related to the failure to comply with the conditions for issuing VAT invoices, failure to show prices inclusive of VAT, and failure to display the VAT certificate in a visible location.

The NBR also identified several violations that are considered suspicious of Excise evasion, in which legal actions will be taken against violators, and reported those who are proven to have committed evasion crimes which may be punishable by imprisonment for one year and a fine equivalent to double the evaded excise.

The NBR emphasised that the cooperation of businesses and consumers is integral to the success of the ongoing inspection campaigns to achieve the highest compliance standards.

The NBR also urges all concerned parties to report any violations or evasions of the VAT or Excise law by contacting the NBR call center at 80008001 available 24 hours, 7 days a week, or through the National Suggestions & Complaints System (Tawasul). Additionally, detailed information is available on the NBR’s website (www.nbr.gov.bh).